The year 2025 is witnessing a tectonic shift within the DeFi ecosystem. This transformation is catalyzed by BlackRock’s tokenized fund achieving near-instantaneous liquidation via Aave V4’s cross-chain liquidity layer, the Trump family injecting political capital into RWA protocols, and legacy giants like Uniswap (UNI), Aave (AAVE), and MakerDAO (MKR) unveiling ambitious V4 and multi-chain deployment plans since April. This convergence of TradFi’s accelerated entry and DeFi’s relentless technological innovation is quietly heralding a new phase of structural upgrade for the entire ecosystem.

DeFi is no longer a peripheral experiment in on-chain finance but is rapidly evolving into a critical component of global financial infrastructure, a pivotal nexus for capital flows, and a primary battleground for user acquisition.

The 2025 DeFi Landscape: A Triple Paradigm Shift – Regulatory Onboarding, Institutionalization, and AI-Driven Liquidity Restructuring

While mainstream cryptocurrencies like Bitcoin and Ethereum experienced volatile but upward-trending prices in 2025, mainstream DeFi blue-chips and RWA tokens demonstrated steadier appreciation. This market optimism and the subsequent drive for ecological upgrade are powered by three core catalysts: Regulatory Onboarding, Institutional Entry, and the confluence of AI Integration & Liquidity Restructuring, defining the new paradigm for DeFi in 2025.

Cutting-edge advancements, particularly Bitcoin staking, RWA tokenization, and Agent AI applications, are driving unprecedented AI integration and liquidity restructuring, unlocking vast new potential for the DeFi ecosystem. Propelled by these emerging narratives, RWA and restaking have emerged as the hottest sectors. The market narrative is shifting from traditional DeFi activities like liquidity mining and lending towards structural transformations with greater real-world applicability, enhanced compliance, stability, and integration with novel technological scenarios.

On the flip side, DeFi continues to grapple with the persistent dilemma of the technical efficiency versus traffic paradox.

The Technical Efficiency vs. Traffic Paradox

Despite boasting a settlement speed 17 times faster than traditional finance (Ethereum L2 average TPS of 2,100 vs. SWIFT’s 120) and a 90% reduction in costs (average transaction fee of $0.03 vs. $26 for cross-border remittances), DeFi suffers from acutely imbalanced traffic distribution.

For instance, the lending protocol Venus reports an on-chain borrowing volume of $1.9 billion, yet 70% of new protocols have a TVL stagnating below $5 million. The top ten protocols command over 65% of the total TVL share, and 90% of long-tail DEXs struggle with fewer than 1,000 Daily Active Users (DAU).

This imbalance stems partly from the “Matthew Effect” of institutional order flow: compliant venues like Uniswap and Hyperliquid attract the deep liquidity of large-block trades from traditional giants like JPMorgan and Goldman Sachs. Uniswap boasts over 480,000 daily users, while 90% of long-tail DEXs languish below 1,000 DAU.

Furthermore, this imbalance originates from DeFi’s inherent contradictions:

- Technical superiority does not auto-translate to traffic: Smart contract execution efficiency ≠ user cognitive efficiency.

- Security and user experience exist in a trade-off: Risk control mechanisms like over-collateralization elevate the barrier to entry.

- Multi-chain ecosystems exacerbate fragmentation: Users are scattered across 80+ public chains, causing protocol customer acquisition costs to surge by 300%.

TaskOn’s Pivotal Role

DeFi necessitates a traffic redistribution engine to convert its technical advantages into scalable user growth – this is precisely the pivotal solution the TaskOn platform provides.

DEXs: The Battle for Traffic Amid Liquidity Fragmentation

By mid-2025, monthly DEX trading volume surpassed $400 billion, a 37% increase from the 2021 peak. However, beneath this high growth lies a landscape fraught with soaring customer acquisition costs, a fragmented user experience, liquidity segmentation, and highly uneven development.

The DEX sector exhibits a pronounced Matthew Effect: Uniswap dominates 70% of the spot trading volume, while 90% of long-tail DEXs have fewer than 1,000 DAU. While SushiSwap is deployed on 12 chains, its TVL on Polygon zkEVM is a mere 5% of its Ethereum Mainnet TVL. Within the thriving multi-chain ecosystem, new chain user activation costs have reached $85 per person, a 300% increase since 2023.

The user experience is fragmented across chains: SushiSwap users must manually switch between 12 networks to execute cross-chain trades. Liquidity fragmentation is also severe, exemplified by QuickSwap’s TVL on Polygon zkEVM being only 3% of its mainnet TVL.

Moreover, DEX technical advantages, such as sub-second settlement and zero Gas fees, are severely misaligned with their traffic acquisition capabilities. Activating these advantages requires lower-cost methods for user onboarding and education, allowing users to experience these benefits firsthand. Addressing these challenges makes reconstructing user engagement through behavioral incentives particularly crucial.

1. THENA: On-Chaining Real-World Behavior to Build a Growth Flywheel

THENA, a decentralized spot and derivatives DEX on BNB Chain, positions itself as a DeFi super-app. By integrating multiple modules like spot/perpetual DEX, social trading, and cross-chain bridges, it aims to be a DeFi platform offering a CEX-like experience.

THENA’s core challenges addressed via TaskOn revolve around liquidity fragmentation and high user education costs.

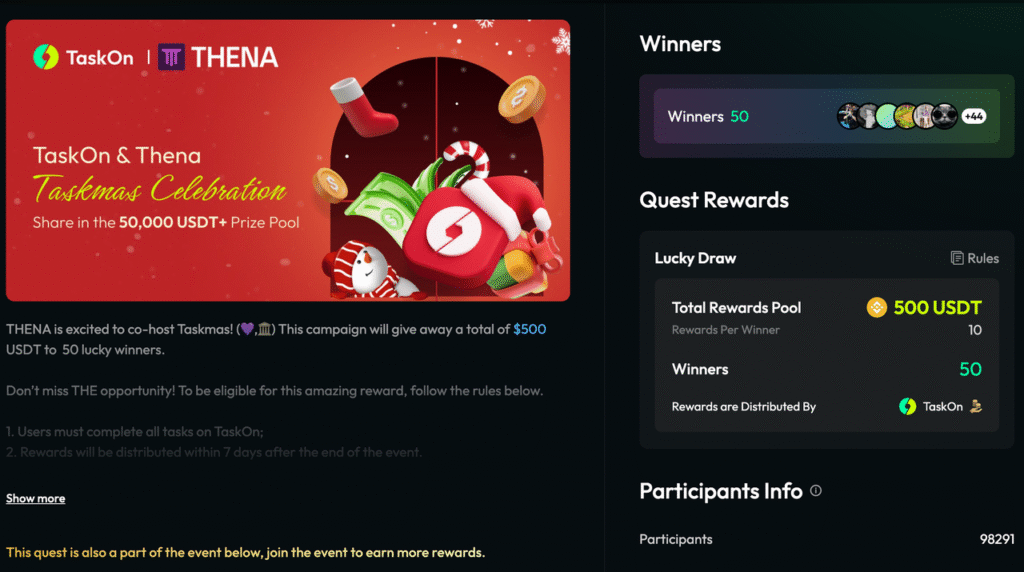

THENA’s community operations excel at leveraging TaskOn’s tools and traffic, such as actively participating in events like TaskOn’s Takmas Carnival and Cupid Carnival. Coupled with external traffic empowerment, they set up internal task series, guiding users to participate via Quests. Dual subsidies (on and off-platform) heighten user enthusiasm and stickiness. Aggregating social media tasks and distributing platform quests through TaskOn effectively addresses their challenges.

THENA’s focus on TaskOn Quests includes:

- Social Media Interaction: Participants follow THENA’s X account, retweet relevant posts, join the Discord community, etc., boosting project interactivity and visibility, strengthening user-project connections, and enhancing stickiness through community engagement and consistent information flow.

- Discover THENA: Tasks involve visiting the THENA website, completing on-chain interactions, claiming airdrops, performing cross-chain or on-chain swaps, etc. Interspersing tasks with rewards educates users and cultivates habits, teaching them about derivatives trading and how to use THENA.

- Join the Community: Tasks like joining the Telegram group or obtaining roles in THENA’s Discord server allow users to participate deeper in the ecosystem, becoming collaborative contributors rather than just platform users.

TaskOn’s growth flywheel is a self-reinforcing model based on bilateral network effects, data-driven optimization, and ecological synergy. Its core logic connects projects and users through technical tools and incentive mechanisms, creating a positive cycle: demand attracts supply → supply creates value → value feeds back into the ecosystem.

What do these core TaskOn functionalities bring to THENA?

- Community Engagement: THENA’s Discord channel saw a surge in participation, with effective interactive discussions, role-based tasks, and exclusive updates keeping users active and connected.

- Expanded Reach: TaskOn-powered quests for THENA attracted over 320,000 participants, with single events exceeding 120,000 participants, significantly boosting THENA’s exposure and creating a virtuous cycle for ecosystem awareness and participation.

- Exponential Social Media Growth: A dramatic surge in social media followers pre- and post-quest highlighted the success of the campaign in enhancing brand awareness and sparking interest among potential users.

2. DragonSwap: Sei Ecosystem’s DeFi Hub Traffic Breakthrough & Carnival Growth Flywheel

As Sei’s DeFi ecological hub and its first full-stack protocol integrating AMM, prediction markets, and LST (Liquid Staking Tokens), DragonSwap is designed with user-friendliness and community drive in mind. It has evolved into the highest-performance parallel liquidity hub operating on Sei V2, leveraging Sei’s parallel processing and low latency for sub-second trade settlement. It consistently ranks among the top 3 in Sei ecosystem TVL, with core trading pairs like wETH/SEI accounting for 35% of the chain’s depth.

Despite its advantageous ecological positioning, multi-chain expansion led to liquidity fragmentation. Deployed on 6 chains (Sei, Polygon zkEVM, etc.), users must manually manage funds across 12 independent pools, with LP yield volatility exceeding ±40%. The 30-day user retention data shows a churn rate as high as 65%. Furthermore, the relative obscurity of the Sei ecosystem and low EVM compatibility result in minimal external user migration.

These issues troubled DragonSwap approaching its TGE. Partnering with TaskOn helped solve the challenges of organic traffic growth and retention pre-TGE. So, what was TaskOn’s breakthrough solution?

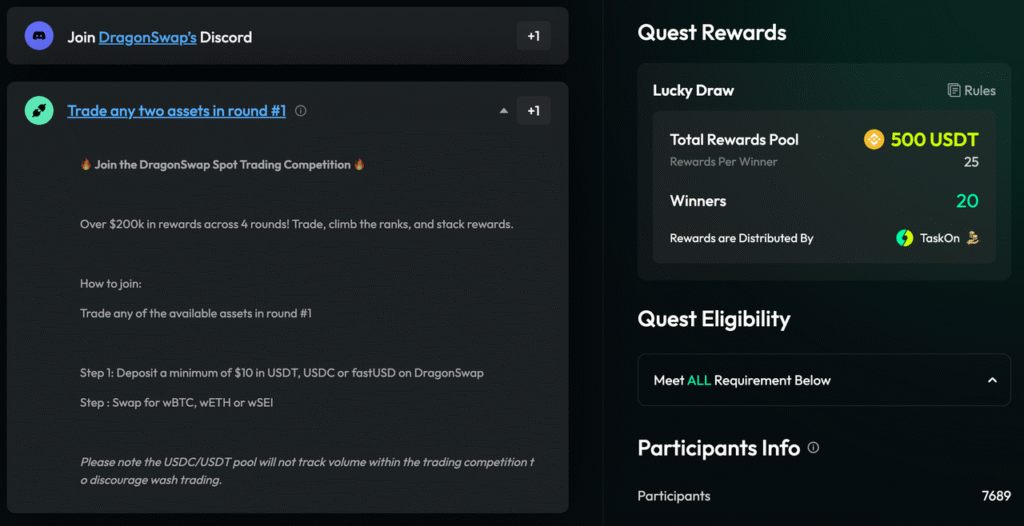

First, DragonSwap used Quests on TaskOn for community building and X follows to accumulate a foundational social media following pre-TGE.

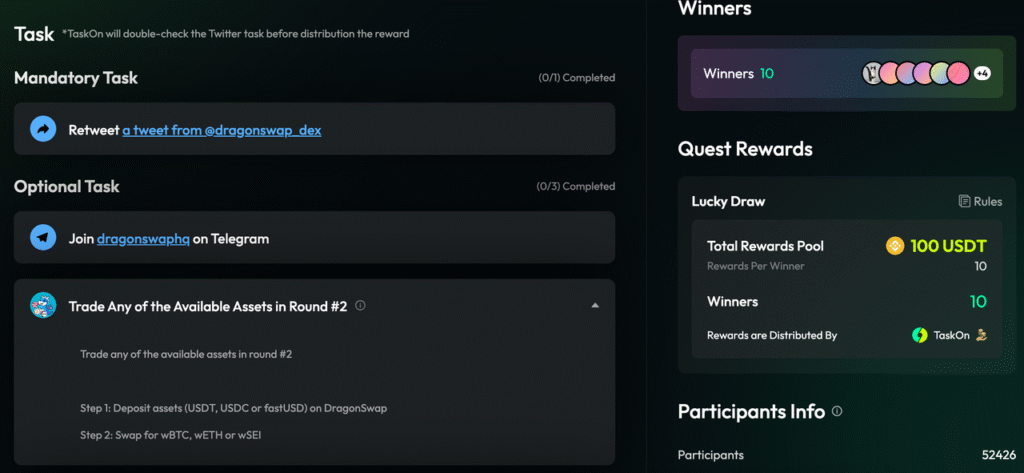

After retaining users on the platform, DragonSwap set up daily on-chain swap tasks to guide user education and behavior binding. Simultaneously, they promoted an on-chain DragonSwap spot trading competition, continuously incentivizing on-chain transactions to address their own liquidity fragmentation issue.

After the initial round of on-chain trading education, where user behavior received positive reinforcement and marking, participating users were more willing to engage in a four-round trading competition for higher-tier incentives. The subsequent trading period garnered significant exposure

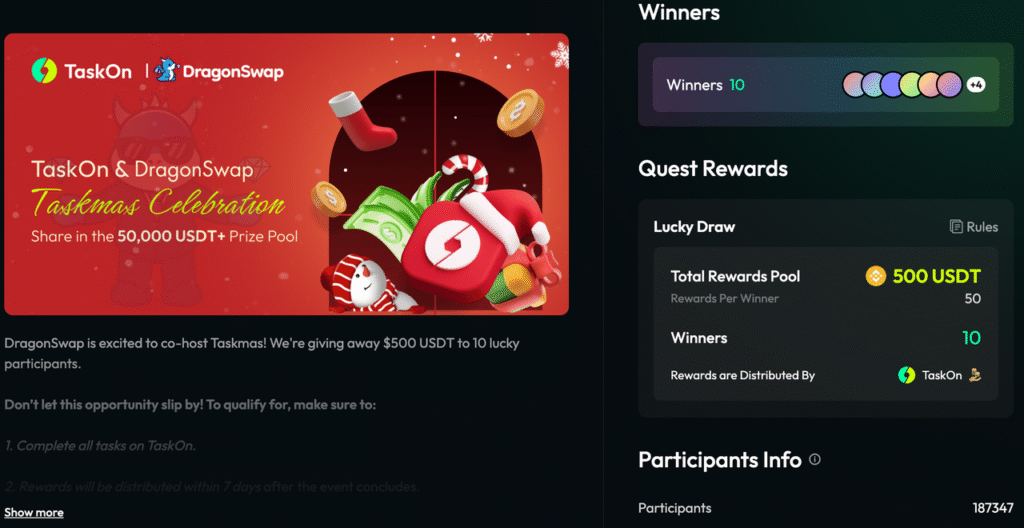

Participating in co-hosted carnival events like Taskmas, by joining a shared prize pool, expanded the event’s scale and exposure. This further increased social media followers and TG/Discord community members. Driven by Taskmas’s exposure, DragonSwap’s high rewards, and simple social tasks, the event attracted over 180,000 participants. Over 200,000 on-chain users were captured pre-TGE. Its follower count within TaskOn’s “communities” feature approached 200,000.

In contrast, DragonSwap’s total follower count across all platforms pre-TGE was also around 180,000.

TaskOn’s Quest campaigns, especially joint multi-project carnivals, are ideal arenas for pre-TGE cold starts. The Taskmas event gathered 60+ projects, a $50,000 USDT prize pool, and over 1.75 million participants in total, providing a diverse participant base for the market.

The subsequent Cupid Carnival further increased scale across projects, participants, and prize pool.

The DragonSwap case demonstrates that TaskOn, through behavioral financialization (converting user actions into tradable equity/value), achieved traffic and stickiness breakthroughs.

By providing specific conversion scenarios, DragonSwap compensated for its operational shortcomings and user viscosity, broke free from traffic dilemmas, and achieved explosive growth on the Sei platform.

This same pathway is replicable for the DeFi ecosystem: leverage a project’s strengths, combine them with TaskOn’s behavioral leverage, educate users through incentives, tag user behavior, reduce operational friction, increase usage stickiness, and ultimately achieve dual growth in traffic and users.

3. AarK Digital: Tapping into New Growth Engines for On-Chain Trading

Aark Digital is a leading 1000x leverage DEX on Arbitrum and the first DEX to offer comprehensive leverage while amplifying Ethereum staking yields. It has developed into a next-gen decentralized perpetual trading platform, providing CEX-like efficiency with DeFi security and transparency, handling a daily trading volume of $200 million.

To achieve CEX-like liquidity depth, Aark employs a virtual liquidity pool model where LPs remain the counterparty to traders. Utilizing a Parallel Market Maker (PMM) framework, Aark mirrors liquidity from Binance and Orderly Network, ensuring CEX-grade depth in a decentralized environment, reducing slippage and price impact even during high volume periods.

Powered by Orderly Network’s off-chain execution model, Aark enables Gas-free trading. Its user base ranks third among decentralized perpetual trading platforms.

However, AarK Digital faces challenges: the derivatives DEX sector is dominated by dYdX and Hyperliquid (70% market share), leading to sluggish user growth for AarK; the high complexity of the sector results in massive new user education costs and lack of organic traffic growth; consequently, its token performance has been sluggish.

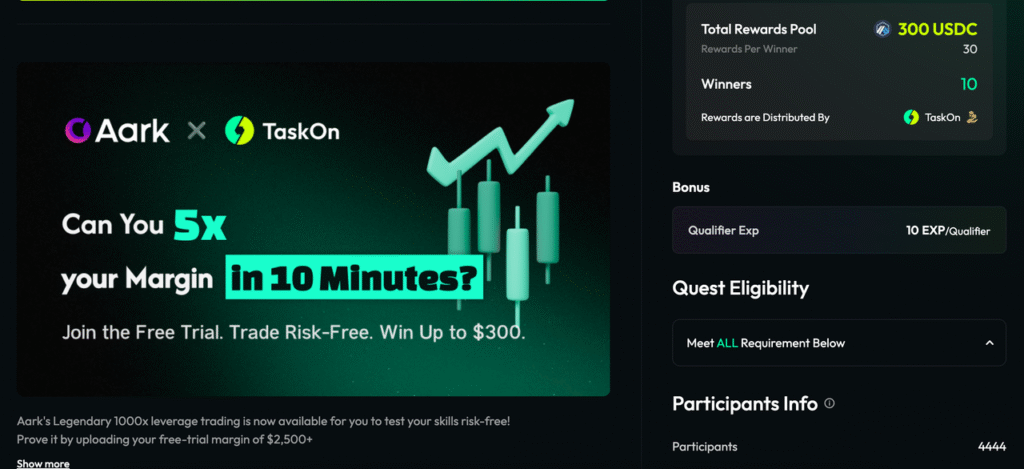

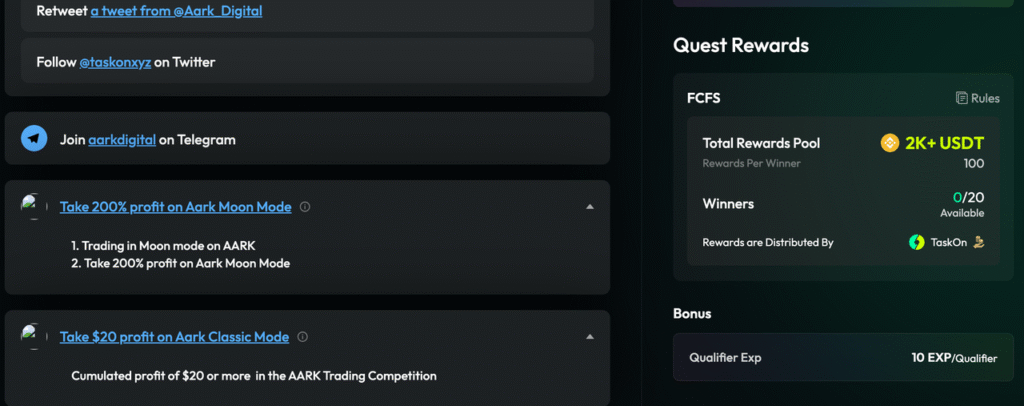

To attract new users and drive on-chain trading, AarK Digital chose TaskOn for a series of on-chain trading campaigns.

Step one was cultivating user habits and reducing risks for novice users. AarK launched a risk-free trading win campaign on TaskOn, using substantial rewards to encourage users to experience risk-free leverage activities, nurturing potential users for the perpetual market.

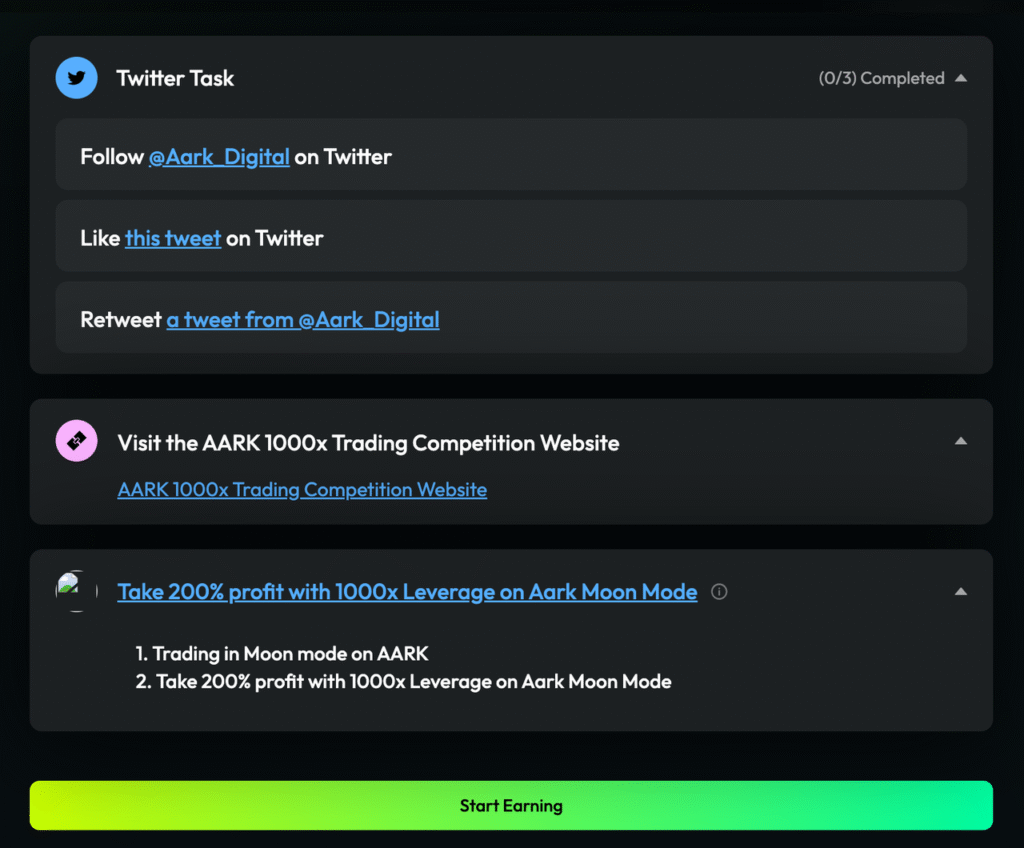

AarK Digital fully utilized TaskOn’s task modules in its campaign design.

The trading competition logic employed tiered tasks:

from learning about the platform -> free trial of risk-free leverage -> depositing small funds -> profiting.

Simultaneously, TaskOn activities complemented their platform’s trading competition, which featured a prize pool of several hundred thousand USD to attract experienced traders.

This series of campaigns progressively cultivated user habits, forming a positive flywheel:

new user experience -> community precipitation -> trading competition. At key moments, like ranking top 3 on DeFiLlama, social media incentive campaigns were set up to boost awareness.

While absolute numbers might not be as stellar as other projects, the conversion of precise met their specific needs. The combination of series of activities ultimately nurtured TaskOn participants into loyal user groups.

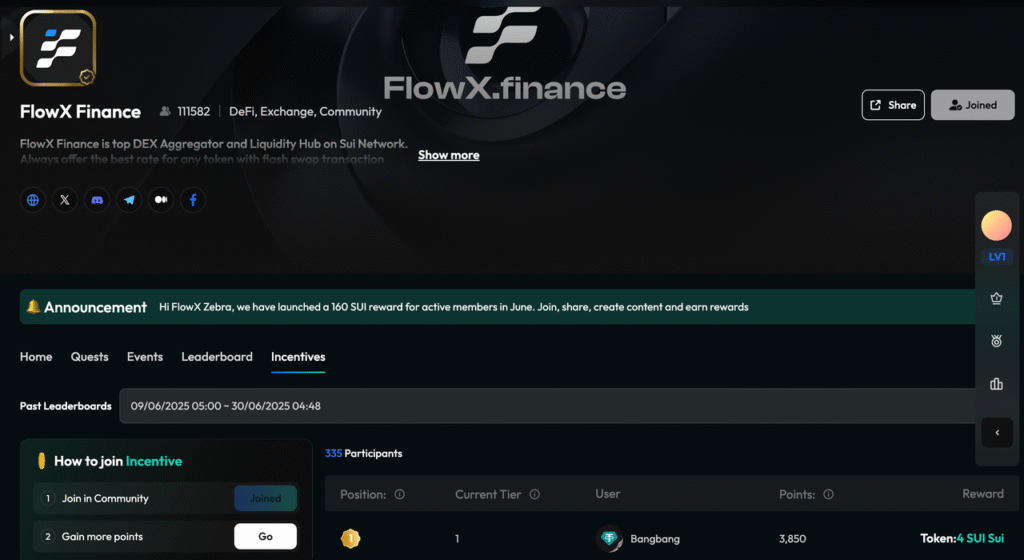

4. FlowX Finance: Aggregating and Precipitating Community Traffic

FlowX Finance is a leading DEX aggregator + liquidity hub within the Sui blockchain ecosystem. It aggregates liquidity from multiple Sui DEXs (like Cetus, Turbos), providing users with optimal trading routes and significantly reducing slippage and transaction costs. It focuses on optimizing the trading experience and improving capital efficiency through technological innovation, becoming a core hub for Sui on-chain transactions.

The Web3 ecosystem is highly fragmented; users are scattered across different blocks with high information barriers. Customer acquisition and retention are significant challenges. Conversely, users lack effective ways to discover quality projects. TaskOn, as a Web3 task platform, acts as a bridge, combining “Web2 traffic entry + Web3 native experience” to build a Web3 growth flywheel.

Traffic is always a primary pursuit in Crypto. Most projects find that traffic from third-party channels, especially users attracted solely by incentives to perform a specific task, often has low loyalty, low retention, and ultimately poor conversion rates.

In its collaboration with TaskOn, FlowX Finance cleverly utilized a core TaskOn feature – Communities – to create positive incentives for user retention, ultimately converting them into loyal platform users through a loyalty program.

FlowX Finance set up daily check-in tasks within its Community for onboarding -> X likes/interactions -> X content creation. This encouraged community users to participate in daily X tasks and discussions, generating topical content on X and deepening their understanding of the platform’s plans. Participants earned points as rewards.

The community loyalty program revolves around these points. Users with higher points indicate greater interaction and participation heat. Regular incentive leaderboards are updated, and top users receive rewards like Sui token airdrops.

This positive incentive structure more easily cultivates user interest and loyalty. Later, these points could be integrated with community benefits for more loyalty program perks, maintaining positive user growth.

Through these series of activities, FlowX Finance garnered over 100,000 users in its TaskOn Community. This fan base directly contributed to the massive success of its Quests on TaskOn, including attracting over 140,000 participants in the Taskmas celebration event.

The essence of TaskOn’s Communities is the central nervous system for Web3 growth. Through the loyalty system, it helps projects build a closed loop of user assetization -> behavioral datafication -> automated growth.

Growth Leverage Achieved by Other Top DEXs via TaskOn

| Name | Introduction | Pain Points | Activity Type | Outcome |

|---|---|---|---|---|

| SyncSwap | A leading DEX on zkSync Era, offering high-efficiency and low-cost trading. | Liquidity relies heavily on incentives; token launch delayed; significant decline in on-chain metrics. | zkSync Carnival Week; focused on on-chain activities. | 40,000+ participants |

| Rubic | A multi-chain DeFi aggregation protocol focused on solving blockchain “isolation effect”. | Weak user stickiness for aggregators. | Emphasis on cross-chain or on-chain interactions. | 12,000+ participants |

| ProsperEx | A universal DEX integrating RWA and AI. | High user acquisition cost; low traffic conversion rate. | Funtastic Christmas Carnival; new user registration + social media tasks. | 4,500+ participants |

| Zebra | A DEX on Scroll, providing users with secure and reliable one-stop liquidity services. | Weak token value support; TVL and user numbers below expectations. | Swap + Add Liquidity tasks. | 7,600+ participants |

| QuickSwap | A DEX on the Polygon network, forked from Uniswap. | Token value decline; lagging ecosystem innovation. | Funtastic Christmas Carnival; social media tasks. | 8,500+ participants |

| SushiSwap | A major DEX in the Ethereum ecosystem, known for forking Uniswap, introducing SUSHI, and liquidity mining. | Token price decline; governance controversies. | Funtastic Cupid Carnival; mandatory on-chain tasks. | 1,900+ participants |

| 1inch | A core DEX aggregator in DeFi, evolving into a full-stack portal; | Slowing growth; low user retention rate. | Funtastic Christmas Carnival; $100 Swap task. | 16,000+ participants |