As mentioned earlier, regarding the current ecological shifts in the DeFi market,DeFi is no longer a peripheral experiment in OnChain finance but is rapidly evolving into a critical component of global financial infrastructure, a pivotal nexus for capital flows, and a primary battleground for user acquisition.

The DeFi continues to grapple with the persistent dilemma of the technical efficiency versus traffic paradox.

Despite boasting a settlement speed 17 times faster than traditional finance (Ethereum L2 average TPS of 2,100 vs. SWIFT’s 120) and a 90% reduction in costs (average transaction fee of $0.03 vs. $26 for cross-border remittances), DeFi suffers from acutely imbalanced traffic distribution.

For instance, the lending protocol Venus reports an on-chain borrowing volume of $1.9 billion, yet 70% of new protocols have a TVL stagnating below $5 million. The top ten protocols command over 65% of the total TVL share, and 90% of long-tail DEXs struggle with fewer than 1,000 Daily Active Users (DAU).

This imbalance stems partly from the “Matthew Effect” of institutional order flow: compliant venues like Uniswap and Hyperliquid attract the deep liquidity of large-block trades from traditional giants like JPMorgan and Goldman Sachs. Uniswap boasts over 480,000 daily users, while 90% of long-tail DEXs languish below 1,000 DAU.

Furthermore, this imbalance originates from DeFi’s inherent contradictions:

Technical superiority does not auto-translate to traffic: Smart contract execution efficiency ≠ user cognitive efficiency.

Security and user experience exist in a trade-off: Risk control mechanisms like over-collateralization elevate the barrier to entry.

Multi-chain ecosystems exacerbate fragmentation: Users are scattered across 80+ public chains, causing protocol customer acquisition costs to surge by 300%.

TaskOn’s Pivotal Role

DeFi necessitates a traffic redistribution engine to convert its technical advantages into scalable user growth – this is precisely the pivotal solution the TaskOn platform provides.

Lending Protocols: Breaking the Traffic Deadlock in the Over-Collateralization Dilemma

Lending protocols are a cornerstone of the crypto market, representing a vital segment of the DeFi ecosystem with a TVL share of 15%-20%. They provide interest income to depositors and supply necessary assets to borrowers, demonstrating strong growth potential and a solid market foundation.

However, the lending market has increasingly become dominated by major platforms, with innovation now focusing on long-tail scenarios. Leading protocols such as Aave, JustLend, MakerDAO (Spark), and Compound hold the majority of market share, though their growth has slowed.

For top players in niche lending sectors—platforms with technological innovation and scenario-based advantages—breaking through traffic bottlenecks and identifying new user sources is essential.

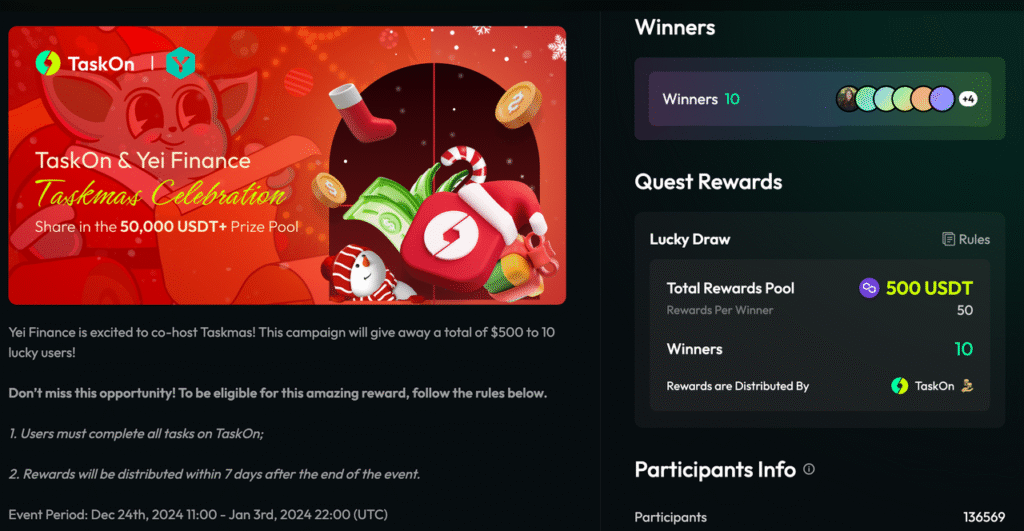

Take Yei Finance, for example, the leading omnichain lending protocol on the Sei ecosystem. It offers a USDC deposit APY of 12.8% and reached a peak TVL of over $600 million. However, it faced challenges such as low user retention and a narrow traffic source. Even with referrals from Binance Wallet, user stickiness remained limited.

Yei Finance partnered with TaskOn and, within just two campaigns, attracted over 170,000 participants. Tens of thousands of on-chain transactions provided Yei with a new traffic source, bringing in and retaining more than 100,000 new users across its community and social media channels—far exceeding expectations.

For Yei Finance, TaskOn offered a simple and efficient task setup. Its task modules allow for clear planning of incremental and on-chain task paths, most of which can be automatically verified by the system. This not only speeds up implementation but also simplifies user management.

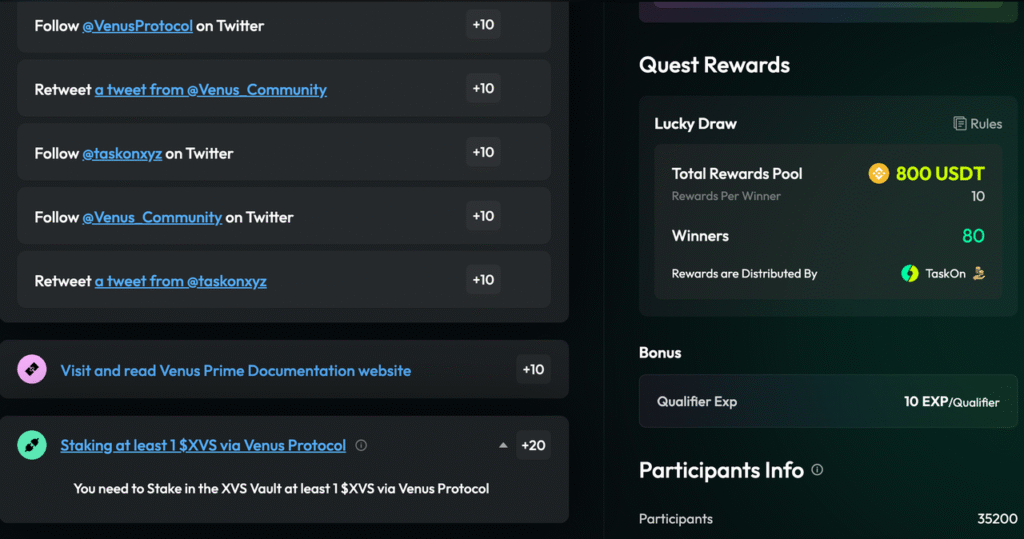

Venus Protocol, which integrates lending and synthetic stablecoin (VAI) minting on BNB Chain and accounts for 30% of BNB Chain’s DeFi TVL—consistently ranking as the top lending platform on the chain—had a clear goal for its Quest on TaskOn: precisely target new on-chain users.

Venus needed to rebuild on-chain trust within its community. On one hand, it required an influx of new users; on the other, it aimed to expand its user base amid relatively low liquidity in BNB Chain’s lending market.

Let’s examine how Venus used TaskOn’s Quest to drive user engagement:

- Christmas Carnival (35,000+ participants): $800 in rewards, social media and community tasks, along with staking at least 1 $XVS in the XVS Vault via Venus Protocol.

- Cupid Carnival (20,000+ participants): $700 in rewards, social media and community tasks, plus staking at least 1 $XVS in the XVS Vault via Venus Protocol and completing any cross-chain or on-chain swap via Rubic’s contract at app.rubic.exchange.

- TaskOn 2nd Anniversary Event (1,800+ participants): $500 in rewards, social media and community tasks, combined with staking at least 1 $XVS in the XVS Vault via Venus Protocol and supplying at least 100 USDT in the Venus Protocol Arbitrum Core Pool.

These tasks collectively attracted over 56,000 unique participants, most of whom completed the staking and holding requirements. This generated substantial on-chain data for Venus and converted tens of thousands of users into long-term retainers.

Why were Yei Finance and Venus so successful? It was no coincidence. TaskOn’s campaign design combines appropriate incentive mechanisms, periodic traffic explosions, precise user referrals, and well-placed promotional displays. Only through the integration of these factors can on-chain tasks achieve such high levels of participation.

For B-side users, TaskOn is a highly suitable Web3 task collaboration platform for marketing and operations. It provides both on-chain and off-chain traffic, helping projects increase exposure and enhance brand marketing. By guiding Web3 community participation through task collaboration and improving efficiency with smart automation tools, TaskOn covers a wide range of marketing growth and community engagement tasks—including social media expansion, data analysis, community interaction, and on-chain transactions. It can be said that TaskOn offers the most diverse task types and the most comprehensive functionality among all task platforms on the market.

For C-side users, TaskOn serves as a hub for market activities and a one-stop earning platform.

TaskOn acts as a bridge connecting B-side demands with C-side benefits. It delivers steady traffic to projects while providing users with abundant reward opportunities. Moreover, as TaskOn continues to evolve, it has expanded beyond mere traffic metrics. In addition to pure user growth, its periodic large-scale campaigns guide users through immersive multi-week journeys. For example, the ultimate goal for lending platforms is to enhance on-chain data activity and increase transaction volume. Through TaskOn’s sophisticated design and educational approach, users now better understand how to explore platform value and earn incremental rewards by participating in ecosystems.

Users who complete these tasks and learning journeys do not merely perform on-chain operations for rewards—though that may have been their initial motivation. As they grasp the value propositions of these lending platforms, many choose to continue holding and engaging. Data shows that after participating in Quest campaigns, community retention can sometimes exceed 50%, and platform retention can surpass 30%. When users truly recognize the utility of these products, they become long-term participants.

Other leading lending market projects achieved rapid growth on TaskOn:

| Name | Introduction | Pain Points | Activity Type | Outcome |

|---|---|---|---|---|

| Hashstack | A permissionless zk-Native money market protocol offering 1:5 loan-to-collateral ratio, significantly enhancing capital efficiency. | Liquidity silos. | Social media + community tasks. | 56,000+ participants |

| Scallop Protocol | The leading lending protocol on Sui. | Competition pressure; user diversion. | Social media + community tasks. | 5,600+ participants |

| LEND Finance | A multi-chain DeFi lending protocol focusing on real yield distribution and cross-chain compatibility. | Lagging ecosystem development compared to leading protocols. | Funtastic Christmas Carnival; social media tasks. | 6,000+ participants |

| Meow Protocol | A decentralized lending protocol providing permissionless borrowing and lending services for multiple asset classes. | Lack of a native governance token; homogenization pressure. | Dreamy Cupid Carnival; lending tasks. | 1,600+ participants |