In the ruthless arena of DeFi, liquidity isn’t just a metric—it’s oxygen. For a new token, the real challenge isn’t building a Discord community; it’s transmuting that community chatter into hard, verifiable On-Chain volume.

QLS, an innovative Memecoin deployed on Solana with a mission to reward eco-friendly behavior, faced the dilemma every DEX-native project knows too well: How do you bootstrap deep liquidity without the massive listing fees and market-maker support of a Centralized Exchange (CEX)?

The answer wasn’t a bigger marketing budget. It was smarter tooling.

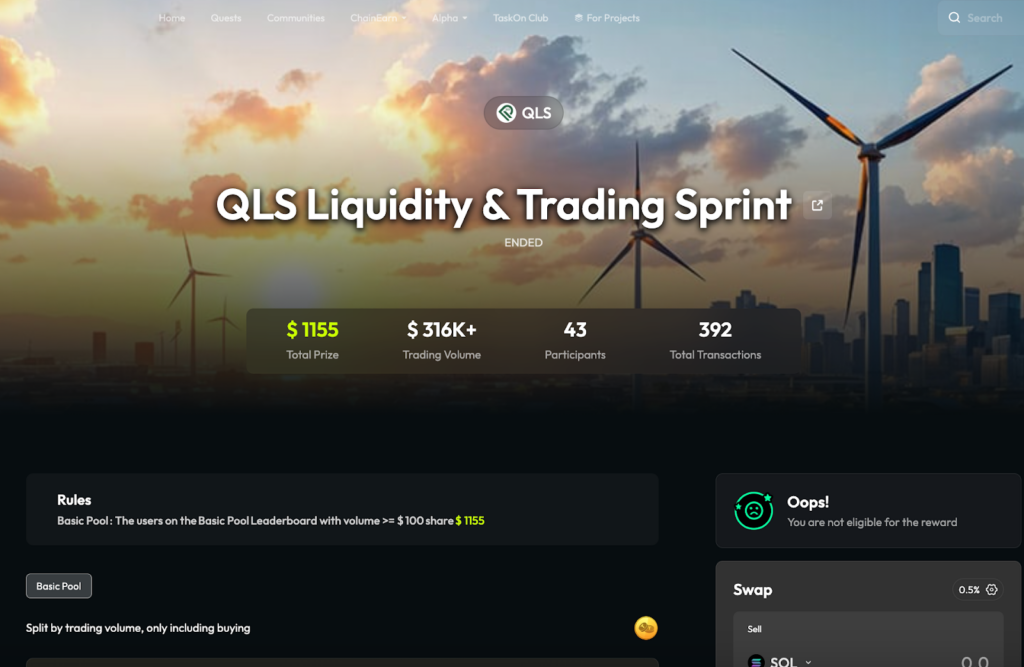

By deploying the TaskOn Trading Race module, QLS executed a masterclass in growth hacking. With a prize pool of just $1,155, they generated $316K+ in real trading volume. They didn’t just run a campaign; they printed their own leverage.

The Conflict: The “Cold Start” in the DEX Trenches

QLS is built on a clear narrative: tokenizing energy conservation and renewable usage. But narrative alone doesn’t fill order books. As a project committed to “total decentralization,” QLS trades exclusively on DEXs.

This purity comes at a price. Without a CEX to act as a traffic funnel, QLS had to solve three critical pain points on their own:

- The Liquidity Freeze: They needed to drastically increase turnover rate and market depth immediately.

- The Conversion Gap: They had plenty of “window shoppers” on Twitter, but needed to convert them into active wallet users.

- The Budget Ceiling: Operating under a DAO model meant every dollar had to count. They couldn’t afford to burn cash on “airdrop hunters” or bots that drain pools without adding value.

They were trying to start a fire in a vacuum. They needed a spark.

Solution: TaskOn Trading Race

The QLS team has realized that the current imperative is to incentivize action—specifically, on-chain contribution.

They turned to TaskOn, specifically utilizing the Trading Race module designed for DeFi and Token growth.

This wasn’t just about handing out tokens; it was about restructuring the incentives of their community. They shifted from asking users to “support the project” to challenging them to “win the game.”

In Web3, the most powerful marketing engine is not an ad—it’s a leaderboard.

The Playbook: Anatomy of a 273x ROI

QLS didn’t just throw money at the wall. They engineered a high-velocity loop using a three-pronged strategy. Here is how they deconstructed the problem:

1. Mechanism: The “Trading as Sport” Dynamic

Instead of a flat reward, QLS implemented a tiered competition. The mechanism was simple but brutal: rank users based on their total QLS trading volume within a set window.

This targeted a specific pair on Solana, ensuring all liquidity flowed exactly where it was needed. By dangling a 1,155 USDT prize pool, they triggered the competitive instinct of the market. It wasn’t just about the money; it was about the flex.

2. Psychology: The “Marginal Gain” Trap

This is where the strategy gets clever. The leaderboard creates a psychological effect known as “loss aversion” combined with “near-miss” psychology.

When a user sees they are only $100 in volume away from jumping up a rank and doubling their reward, they will almost always execute that extra trade. The cost to them is pennies in gas; the gain is status and potential profit.

QLS effectively turned their trading volume into an arcade game where users keep inserting coins to beat the high score.

3. Technology: The Zero-Friction Funnel

The strategy would have failed if the user experience was clunky. In the past, trading competitions required users to submit screenshots or wait for manual verification—a total conversion killer.

- Zero Friction: No screenshots. No forms.

- Auto-Verification: The backend automatically scraped on-chain hashes.

- Instant Feedback: The Live Leaderboard refreshed in real-time.

This created a “FOMO Loop.” Seeing your name drop on the leaderboard in real-time forces you to react, trade again, and reclaim your spot.

The Results: Growth on Steroids

The numbers from this campaign strip away the hype and show raw efficiency. This is what “Capital Efficient Growth” looks like in a bear or bull market.

- Total Trading Volume: $316,000+

- Cost (Prize Pool): $1,155

- ROI: 27,300% (273x)

- Network: Solana

They achieved CEX-level volume activity with a DAO-level budget.

The Takeaway: From “Traffic” to “Finance”

The success of QLS signals a paradigm shift in Web3 marketing. We are moving away from the “Traffic Era”—obsessed with vanity metrics like followers and likes—into the “Financial Era,” where the only metrics that matter are TVL, Volume, and On-Chain Holders.

Trading competitions are the native language of this new era. They respect the user’s on-chain sovereignty while injecting adrenaline into the boring act of swapping tokens.

The lesson is clear: If you want to build a community, open a Discord. If you want to build an economy, start a race.

QLS proved that even in the hyper-competitive Solana ecosystem, you don’t need a massive treasury to win. You just need the right leverage.