In the world of Web3, the most terrifying sound isn’t the alert of a market crash, but the “deathly silence.”

You’ve undoubtedly seen countless Discord channels like this: Before the TGE, it’s deafeningly loud, flooded with eager “Wen Token” inquiries; after the TGE, it’s a ghost town. Aside from the occasional spam ad, all that remains is a “digital graveyard” composed of tens of thousands of zombie profiles. This is the classic “Airdrop Hunter’s Curse”—projects pay for traffic but fail to buy loyalty; users grab the cash and dash, leaving behind nothing but a collapsed token price and a community that’s gone to zero.

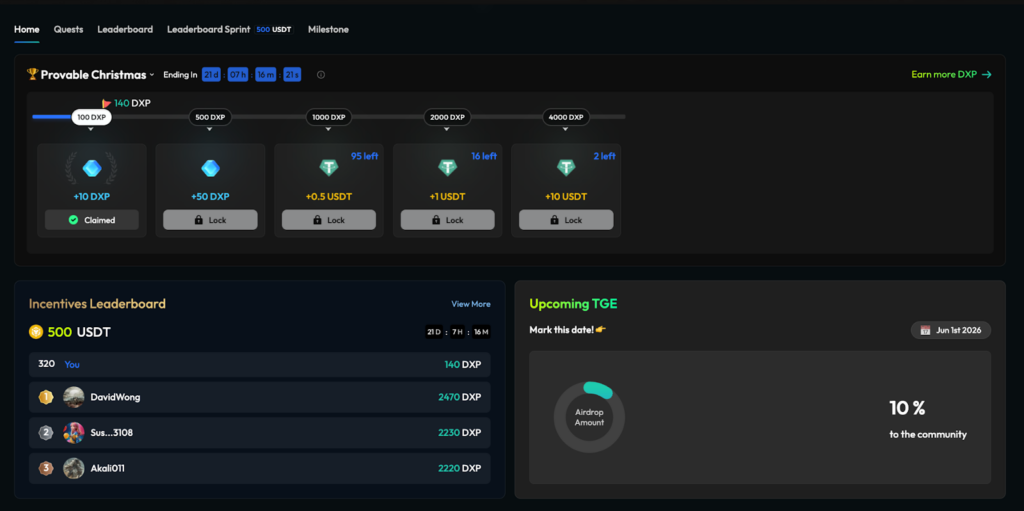

DeathXFun, utilizing TaskOn’s GTC , has constructed a sophisticated “behavioral assetization” system to navigate the long window before their June 2026 TGE.

I. The Dilemma: When “Points” Become Inflationary Waste Paper

In 2025, the Web3 gaming industry stands at a crossroads.

The early days of Axie Infinity opened the Pandora’s Box of P2E , but its reliance on “Ponzi-nomics”—where latecomers pay for the early adopters—has been falsified. The market attempted to pivot to Play-and-Earn, only to face an awkward reality: users are bloodthirsty.

“Mercenary Capital,” accustomed to triple-digit APYs, has zero patience for games requiring Time-investment. Data shows that the retention rate for most GameFi projects drops by over 90% once incentives stop.

Even worse is “Points Fatigue.” From Blast to various L2s, users are numb to the cookie-cutter tasks of “Follow Twitter, Join Discord.” These low-barrier tasks fail to filter for real players and instead attract countless automated scripts, manufacturing a “fake prosperity.”

DeathXFun faces an even stricter challenge: their TGE is set for 2026. How do you convince users to invest real money (BNB) into a betting game during a six-month “token-less vacuum”?

II. The Turning Point: Turning Growth Tools into a “Game Console”

DeathXFun isn’t a traditional GameFi project; it’s closer to a blockchain-based probability betting platform. Its core gameplay is described as “Navigate through dangerous tile rows, avoid death tiles, and cash out.” This mechanism is similar to classic “Minesweeper” or “Cross the River” games but involves the input and return of real money (BNB, etc.).

Most projects treat task platforms as a bulletin board, but DeathXFun views TaskOn as a “Core Component of the Growth Engine.” They made a highly strategic decision: adopting the TaskOn White-label solution.

This means TaskOn’s GTC is deeply integrated via API directly into DeathXFun’s official website. Users no longer need to jump to a third-party platform to complete tasks; instead, they complete the “Play to Claim” loop seamlessly under one domain.

Furthermore, leveraging the Web3 wallet login feature, connecting a wallet logs the user into both the game and the GTC system simultaneously, ensuring real-time data synchronization.

This might look like a UI change, but it’s actually a reclamation of brand sovereignty. TaskOn acts as an invisible “Central Bank” in the backend, listening to on-chain data in real-time, precisely calculating the value of every interaction, and anchoring corresponding points to user behavior. Real growth isn’t about stacking data; it’s about pricing behavior.

III. Deconstruction: The “Three-Stage Rocket” Driving the Frenzy

DeathXFun’s success isn’t magic; it’s math. By deconstructing their TaskOn backend configuration, we can see a rigorous “Three-Stage Rocket” methodology that refines generic traffic into high-value capital step by step.

Stage 1: Funnel Philosophy—Using “Thresholds” to Combat “Sybils”

DeathXFun designed a refined, layered Conversion Funnel.

- Touch: Laddered tasks like following social media, Q&A quizzes, inviting new users, and game trials allow users to gradually understand and interact with DeathXFun.

- Threshold: Setting “Pre-requisite Tasks.” You must read the docs before taking the quiz; you must experience the game before unlocking lotteries or double points for streaks. This filters for cognition and establishes a barrier to entry.

Stage 2: The Math Trap—Locking Users in with “Loss Aversion”

This is DeathXFun’s most counter-intuitive, yet brilliant move. They designed an “Exponential Streak Mechanism.”

Ordinary project points are linear (e.g., sign in daily for 10 points). DeathXFun’s point system in TaskOn GTC is tiered: 10, 20, 50, 100, 150, 200, etc., where:

$$P_t = 150t$$

This means a user’s total yield ($Y$) is a quadratic function of time:

$$S_t \approx 75T^2$$

Let’s look at a shocking data comparison:

- Day 1: You can only earn 150 points.

- Day 180: You can earn 27,000 points in a single day!

This mathematical model creates a massive “Moat Effect.” A veteran user who persists for six months earns 180 times the daily yield of a new user.

Even more ruthless is the “Broken Streak Nuclear Option”: If you forget to log in on Day 181, your daily yield instantly resets to 150. This cleverly exploits human “Loss Aversion” while acting as a barrier for benefit distribution, favoring core daily deep players.

There is also a value game here. Since participating requires a real BNB investment, and few players will blindly pour money in just for points before the airdrop lands, the amount invested becomes a gamble on the leaderboard itself.

Stage 3: Dual Incentives—Balancing “Future Promises” with “Immediate Sustenance”

Before the TGE arrives, DeathXFun implements a Dual Incentives system:

- Long-term (Milestone): Points correspond to future token airdrops, keeping long-term investors hooked.

- Short-term (Sprint): A Leaderboard Sprint opens every two weeks, directly sharing a 500 USDT cash pool.

Leaderboard Sprint: Short-Term High-Frequency Stimulation

- Mechanism: The Sprint leaderboard resets periodically (every two weeks or monthly), offering a 500 USDT cash reward pool distributed according to the DXP points gained within that cycle. The TOP 5 on the list receive an average reward of 80 USDT.

- Opportunity: The Sprint mechanism only counts incremental points within a specific time window. This means a newly joined user, provided they are active enough during that week (e.g., high betting volume, many invites), has a solid chance to surpass old users on the Sprint leaderboard and win USDT.

- Tech: TaskOn’s Sprint module supports automatic Snapshots and periodic ranking resets, allowing the operations team to easily “roll” into new seasons and maintain community competitive vitality.

Milestone Rewards: Long-Term Retention Anchors

Beyond the fierce ranking competition, DeathXFun set up Milestone rewards.

- Setup: When a user’s cumulative points reach 100k, 500k, or 1m, they automatically unlock corresponding NFT badges or a one-time massive DXF pre-mining package.

- Function: This gives “Zen players,” who are unwilling to engage in cutthroat leaderboard PvP, a clear sense of purpose and progression.

IV. The Results: Not Just Data, But a Moat

This combination of tactics delivered astonishing results.

Through TaskOn’s anti-Sybil system, DeathXFun successfully shut out massive amounts of scripts. Simultaneously, they constructed a form of “Proof of Capital.” Since the core source of points is “Daily Gaming,” any attacker wanting to farm points must pay daily Gas fees and bear the risk of losing bets. Compared to zero-cost farming projects, this attack cost is high enough to make bot studios walk away.

V. Sublimation: The Second Half of Web3 Growth

DeathXFun’s story offers a lesson to all Web3 practitioners: The best growth isn’t about pleasing everyone, but finding the consensus holders willing to play this “dangerous game” with you.

If Web2 growth was about “managing traffic with Excel sheets,” Web3 growth is about “designing game theory with smart contracts.” TaskOn provided the infrastructure, building tasks like Lego blocks; DeathXFun injected the soul, using an “exponential growth” mathematical formula to turn cold interactions into an addictive habit.

Only projects that can encapsulate “business logic” within “entertainment experiences”—like DeathXFun—and replace “tests of human nature” with “data validation,” will survive the bulls and bears to remain standing at the end.