In the current Web3 market fluctuation cycle, the cost of pure “Acquisition” is sky-high while efficiency is diminishing. It is far more crucial to use a consistent yardstick to measure “who is actually worth nurturing” and “which moves truly move the needle,” rather than simply chasing wallet address counts.

On the growth platform TaskOn, leveraging industrial-grade RFM models and Cohort analysis combined with TaskOn’s native stack (Quest, TaskChain, DayChain, Points, Level, Milestone, Benefits Shop, Leaderboard, Anti-Sybil verification, etc.), we can execute a replicable strategy for retention and user segmentation diagnostics. This effectively realizes a refined user operation system for retention and repeat engagement.

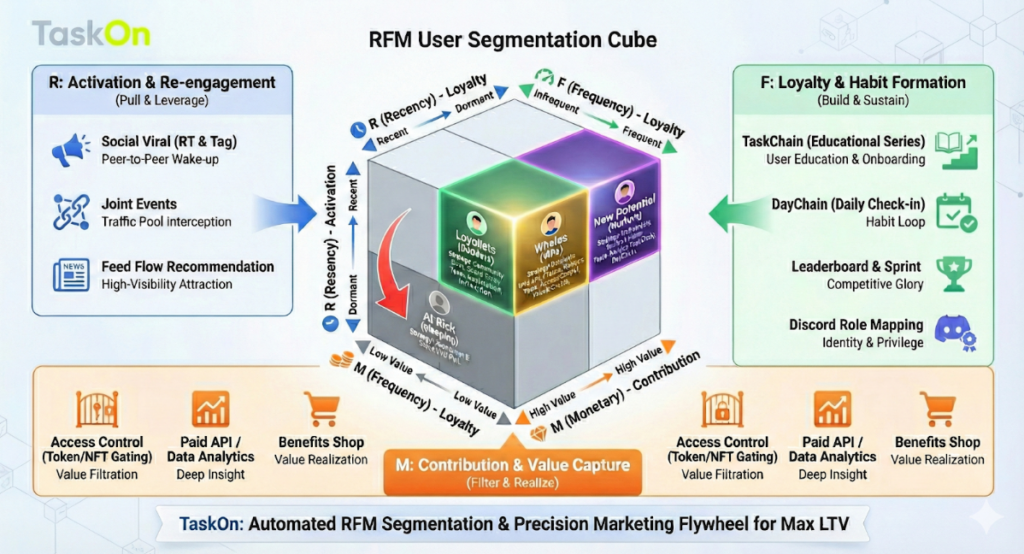

I. The Web3 Version of RFM: Identifying “Who’s Most Worth Keeping”

In the Web3 context, we need to redefine RFM and map it directly to specific metrics and features within TaskOn.

| Dimension | Definition | TaskOn Metrics & Tools |

| R (Recency) | Last Action How close is the user to churning? | Metric: Last Active Date (Time of last completed Quest/TaskChain) Tool: Data Analytics Dashboard |

| F (Frequency) | Activity Frequency How sticky is the user? | Metric: Completed Campaigns Count, Daily Check-in (Consecutive streak days) Tool: TaskChain, Leaderboard |

| M (Monetary) | Value Contribution How “expensive” (valuable) is the user? | Metric: Wallet Balance (Holdings), NFT Holding, Points Redeemed (Value of consumed points) Tool: Access Control (Asset verification API), Benefits Shop |

2. TaskOn RFM User Segmentation Scorecard (B-Side Ops Template)

Projects can refer to the table below, utilizing TaskOn’s EligibilityAccess Control and Data Export features to tag users. Crucially, participation in on-chain Tasks directly differentiates a user’s contribution to the project. You can only achieve retention of high-value users by setting corresponding tiers and point thresholds based on contribution values, and configuring tiered incentives in Points/Level/Milestone and Benefits Shop.

| Tier | R (Recency) | F (Frequency) | M (Monetary – Filtered via Verification Components) |

| High Value (5 pts) | ≤ 3 Days | Consecutive Check-in ≥ 14 Days OR Tasks Completed ≥ 12 times/month | Token/NFT Whale (Holdings reach high threshold) OR Successfully redeemed High-tier Benefits ≥ 3 times |

| Mid Value (3 pts) | ≤ 14 Days | Tasks Completed 4–7 times/month | Active User (Holdings reach mid threshold) OR Successfully redeemed Benefits ≥ 1 time |

| Low Value (1 pt) | > 30 Days | 0 times/month | Newbie/Bot (No holdings/Low holdings) No redemption record |

RFM → “Benefit Binding” Segmentation Strategy

| RFM Combo | Persona | TaskOn Action | Benefit Binding (Example) |

| 5-5-5 | Core High-Value Users | Unlock High-tier TaskChain + Governance/Content Tasks; Invite to Private Domain (Discord/TG) | Benefits Shop: High-value items, Whitelist (WL), Priority Testing, Increased Airdrop Quota |

| 5-4-3 | Active but Shallow Value | Push “Deep Action” Tasks (Trading Volume, Staking Duration, Governance Voting) | Redeem Discount Coupons, Limited-time 2x Points, Level Skip Vouchers |

| 3-4-5 | Whales Cooling Off | Re-engagement Quest + Consecutive Check-in (DayChain) | Exclusive Packs for High-Point Users, Level-Specific Gifts |

| 4-2-1 | New & Low Freq | Onboarding → Newbie Streak (DayChain) | Newbie Coupons, 0-Threshold First Redemption, Points Booster |

By linking RFM grouping directly with TaskOn’s Points/Level/Milestone and Benefits Shop, we create a backend incentive loop: “Use more → Get more rewards → Value increases.”

II. Cohort Analysis: Verifying “If Your Strategy Actually Works”

If RFM answers “Who to target,” Cohort answers “How well are we doing.” In the TaskOn backend, focus on these Cohort data points:

1. Key Metrics to Watch

- D1 / D7 / D30 Retention: What is the retention rate of new users on Day N?

- First Redemption Rate: How long after registration does a new user make their first points redemption in the Benefits Shop? (This is the core metric for value perception).

2. Diagnostic Logic (How to Read the Data)

| Cohort Phenomenon | Diagnostic Conclusion | TaskOn Optimization Strategy |

| High D1, D7 Crashes | High pass rate for newbie tasks, but lacks follow-up appeal. | Introduce DayChain (7-Day Check-in) to lock in Week 2 retention; Add prompts for Level upgrades. |

| Low D30 Retention | Insufficient long-term value; users are “farming and dumping.” | Launch scarce assets in Benefits Shop; Enable Seasonal Leaderboard. |

| Low First Redemption Rate | Weak value perception of Points; users don’t see the utility. | Optimize Benefits Shop selection; Emphasize USDT/Whitelist redeemability in task descriptions. |

III. Closing the Loop: The TaskOn Data & Incentive Flywheel

Connect RFM and Cohort to build an automated growth flywheel using TaskOn infrastructure:

- Action Layer: Users generate R and F data via Quest / TaskChain / DayChain.

- Verification Layer: Confirm user M (True Value) via API / Anti-Sybil / Token Gating.

- Incentive Layer: Actions convert to Points / EXP, accumulating to raise Level.

- Value Layer: High Level unlocks premium Benefits Shop rights, achieving Milestone.

- Feedback Layer: Leaderboard displays rankings, stimulating a new round of R and F.

| Module | What You See / Can Do | Relation to RFM / Cohort |

| Quest / TaskChain / DayChain | Task completion records, streaks, stepped deep tasks | Produces R, F metrics; Builds the path to “Increase F / M” |

| Verification (API / Contract / Sign) | Action authenticity & Anti-Sybil | Credibility of M; Improves data quality |

| Points / Level / Milestone | Growth path & Visualized progress | Acts as the “Ops Feedback Loop” for RFM, making incentives sharper |

| Benefits Shop | Redemption records, Item preferences | Connects “Action → Value Return”; Measures First Redemption & Repurchase |

| Leaderboard | Ranking & Glory-driven | Boosts F and consecutive activity; Positive feedback for D7/D30 retention |

| Referral / Invite Quality | Effective invite rate, bot detection | Forms the “Ecosystem Contribution” dimension of M |

IV. Minimum Viable “Growth Dashboard” Field List

- Segmentation Dimensions: Segment users by Level, Milestone achievement, Task Type (Social/On-chain/Gov/Content), Channel, and Region to view changes in high-quality user ratios.

- Core Metrics: D1/D7/D30 Retention, Tasks Completed (Last 30 Days), Consecutive Check-in Days, First Redemption Rate, Repurchase Count, Avg. Redemption Value, Valid Invite Rate, Trading/Staking Volume × Days, Accepted Content Count, Milestone Completion Rate.

- Strategy Slots: Is the Benefits Shop showcase exposed? Is stronger Verification enabled? Are Recall Quests active? Are Leaderboard bonus rewards turned on?

V. Conclusion

TL;DR: B-side projects should not treat TaskOn merely as a tool to “dispatch tasks,” but rather as a lightweight Web3 CRM system.

- Use RFM to segment users—stop sending the same tasks to everyone.

- Use Cohort to monitor data—ensure every Campaign lifts retention, not just vanity traffic numbers.

- On TaskOn, plug both into the Points → Level → Milestone → Benefits Shop incentive circuit to form a true growth closed loop: “Use more → Get more → Repurchase more.”