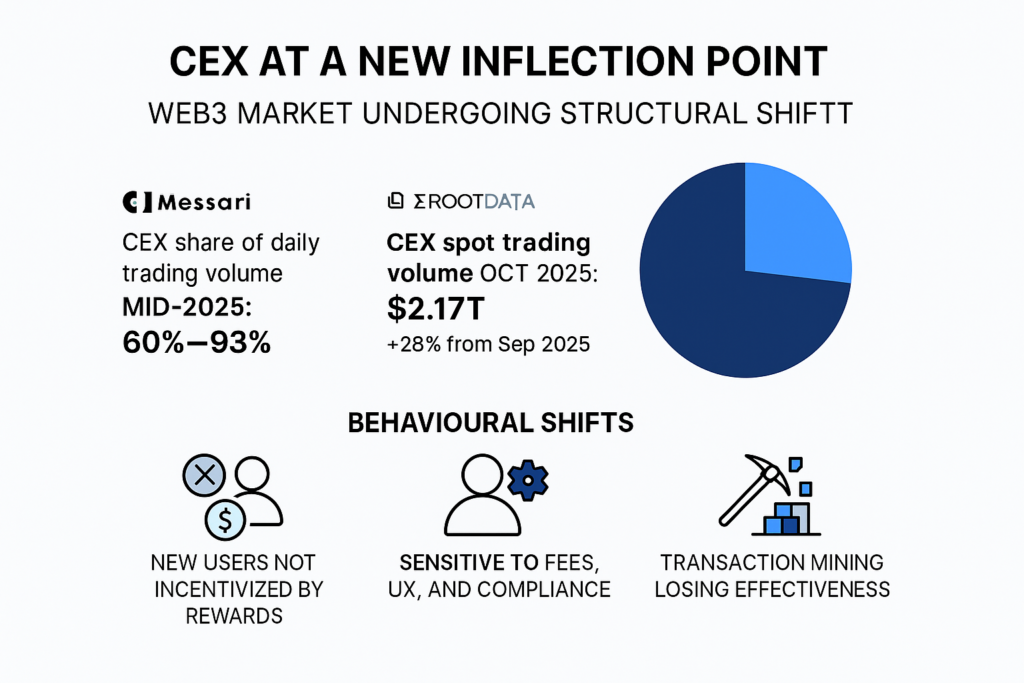

The Web3 market is undergoing a structural realignment, and global Centralized Exchanges (CEXs) are standing at a new inflection point for growth. The data speaks for itself: according to Messari, as of mid-2025, CEXs account for 60-93% of daily trading volume. Furthermore, RootData indicates that in October 2025, CEX spot trading volume hit approximately $2.17 trillion, a 28% month-over-month surge from September.

However, against this backdrop of massive volume growth, user behavior is undergoing a fundamental pivot:

- New users are no longer easily moved by simple “sign-up rewards.”

- Veteran users are increasingly sensitive to fee structures, UX, and transparency.

- Regulatory compliance, high-quality growth, and real market depth have replaced raw volume as the core competencies.

The CEX battlefield has shifted from a volume game to a structural war. It’s about transforming the one-time arbitrage of “Transaction Mining” into the long-term retention of “Quest-to-Growth.”

This is precisely the value proposition of TaskOn: upgrading “trading behavior” from a transactional arbitrage action into a sustainable user growth path. It’s about building a platform that educates users and cultivates loyalty through intelligent tooling.

I. The CEX Traffic Dilemma: The Growth & Incentive Paradox

Currently, CEXs generally face a “Trilemma” of challenges:

1. High CAC, Plummeting Quality

Traditional tactics like airdrops, basic tasks, and referral schemes are losing their edge. The Customer Acquisition Cost (CAC) is skyrocketing, while churn rates are high and loyalty is non-existent.

2. Unstable Depth, Undervalued Activity Structure

Behind the polished platform data lies a grim reality: the majority of users become “zombies” after their first deposit. A significant percentage of users exit immediately after hitting the referral target, leading to a distorted user ratio.

3. Homogenized Incentives & The End of “Transaction Mining”

The once-effective “Transaction Mining” model has become a playground for bots and airdrop studios due to wash trading and matched orders. Real market depth hasn’t increased. The ratio of real humans is low, and the ROI is poor, creating a death spiral of misaligned incentives.

The result? The Matthew Effect intensifies. Top-tier CEXs consume all the traffic, while others face onboarding difficulties, deteriorating user structures, and low retention.

II. The TaskOn Approach: From Transaction to Growth

On the TaskOn growth platform, the logic shifts. Unlike other Quest platforms that focus on a single-core “Quest Incentive” path, TaskOn upgrades “making a trade” into a comprehensive growth journey:

Quest (Campaigns) / Community (Retention) → TaskChain (Education Path) / DayChain (Habit Formation) → Points & Tier System (Segmentation) → Milestone (Stage Benefits) → Benefits Shop (Rights Targets) → Leaderboard / Referral (Honor/Virality).

TaskOn’s ultimate goal is to achieve taskification, stratification, automated verification, and API integration, making it the ultimate tool for simplifying user formation.

- Taskification: Breaking down “trading goals” into verifiable tasks (First Order, HODLing, Swap Targets, Market Making Sprints, Take-Profit/Stop-Loss drills). It guides users “from 0 to 1, from shallow to deep.” From Community Onboarding to DayChain habit building, and finally to Trading Races to boost activity—every step is a quantifiable growth metric. TaskChain, specifically, builds user behavioral loyalty through low-barrier educational guidance where the platform and user grow together.

- Stratification (Segmentation): Using Points/Levels to segregate the user base into L1 (Newbie), L2 (Active), L3 (Contributor), and L4-L5 (Core). Each layer corresponds to different task thresholds and benefits. Every step grants visible points with clear conditions for leveling up. Finally, Milestones set behavioral markers, breaking the upgrade path into achievable goals.

- Auto-Verification & API Integration: Through API, signature, and Order ID verification, TaskOn automatically links “Task Completion” with “Reward Distribution,” lowering Ops costs while boosting credibility.

III. Case Studies: The Real CEX Growth Path

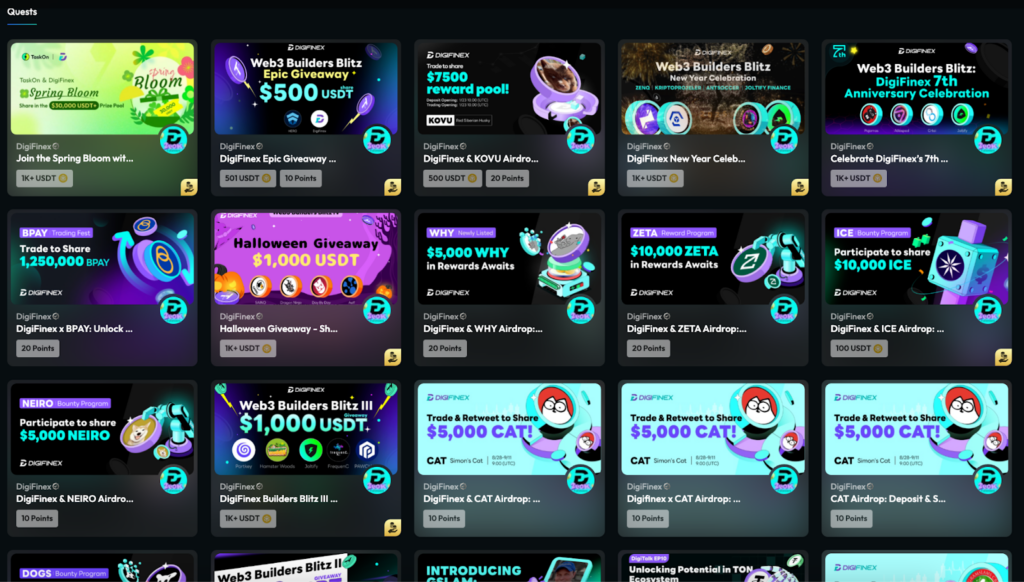

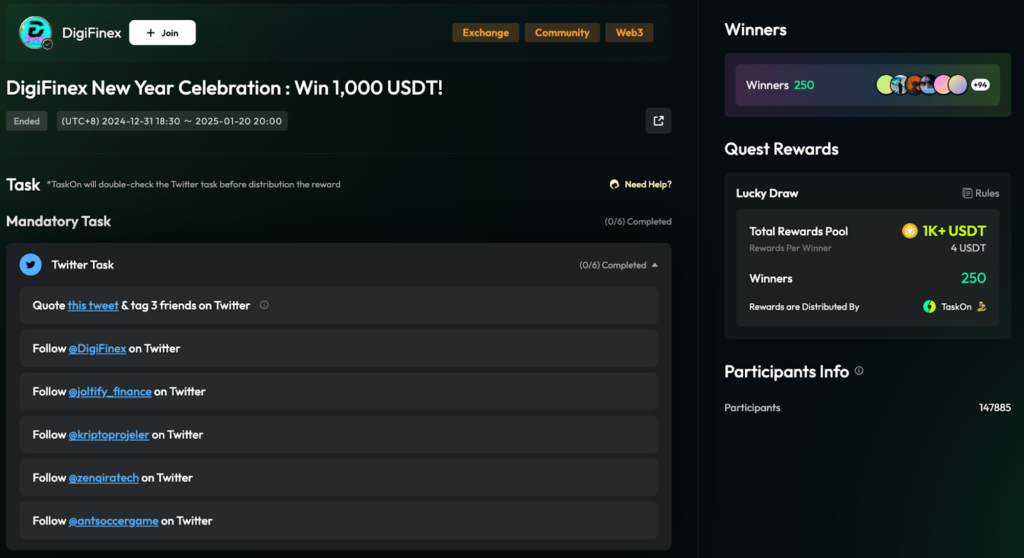

1. DigiFinex Global: Building a Scalable Model with High-Frequency, Low-Barrier Quests

Among all CEXs utilizing TaskOn, DigiFinex is a master of the “Simple is Efficient” logic. They deeply understand the CEX user profile—many are light, “short-term” users. Thus, they designed a high-frequency, low-barrier, easily verifiable, and scalable task system.

- Low Barrier First:DigiFinex’s Quest design is crisp: Follow X, Join Telegram, Register. These daily actions are directly verified via TaskOn’s official components. It minimizes the education cost, making “High Participation → High Completion → High Retention” a natural outcome.

- Verification is Key:DigiFinex prioritizes data that is real and verifiable. This is TaskOn’s stronghold: utilizing Anti-Sybil strategies, API verification, and KYC checks to ensure the CEX reaches real humans, not bots.

- Cyclic Quest Rhythm:DigiFinex knows growth isn’t a one-off event; it’s about rhythmic operations. Their campaigns run for 3–7 days or even months, constantly refreshing the TaskOn Feed Flow. This builds a stable brand rhythm where users return to check “What’s new on DigiFinex.” By offering small but frequent rewards and diverse formats, users perceive a constant “value inflow,” eliminating the post-campaign “vacuum period.”

Result: DigiFinex’s effective user rate on TaskOn significantly outperforms traditional channels.

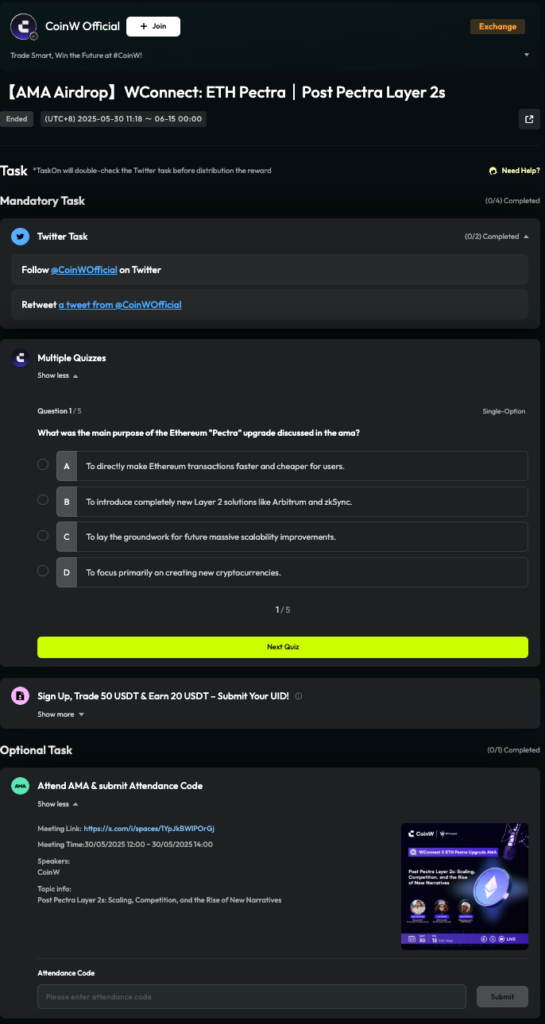

2. CoinW: Knowledge-Driven Growth via AMA x Airdrop x QA

CoinW’s logic on TaskOn is distinct: transforming a one-time AMA (Ask Me Anything) livestream into a complete user education and community growth loop via pre-tasks and interactive quests.

- Multi-Dimensional Task Weaving:AMA isn’t just “listen and grab the airdrop.” It’s split into verifiable Tasks:

- Pre-AMA: RT tweets, Follow official accounts, View rules.

- During AMA: Join the stream, Ask questions in comments, Submit screenshots.

- Post-AMA: Complete QA Quizzes, Surveys, Learn key project points.This “Pre-During-Post” link ensures users actually understand the alpha before claiming rewards.

- From Activity to Content Identity:CoinW executes this frequently. Combined with TaskOn tools, every AMA has matching tasks and points. This brands CoinW not just as an exchange, but as a source of high-quality knowledge.

- Avoiding the “Silence Cycle”:Web3 communities often suffer from the “Event Ends → Discussion Drops → Silence” cycle. CoinW solves this with the Content-Interaction-Incentive Loop using TaskOn as the bridge.

- The Power of QA:The QA section isn’t just multiple-choice questions; it forces users to learn (absorption), generates new questions for the next AMA (engagement), and improves education efficiency (ROI).

Result: CoinW is the prime example of “Educational” and “Content-Driven” growth on TaskOn. The brand is now bonded with “Knowledge Distribution.”

3. ProBit Global: Community-Driven Engine via Gamification

ProBit Global excels at the “Community Interaction → User Growth” path. They leverage multi-platform interaction, structured task chains, and—crucially—Leaderboards.

- High-Frequency Multi-Platform Interaction:ProBit targets the lowest friction points: X (Retweet/Like), Telegram (Check-in/Chat), YouTube (View). These require zero learning curve, ensuring massive participation.

- Daily Connect:By setting up “Daily Connect” mechanisms in the Community module, they turn engagement into a habit.

- Leaderboards & Competition:ProBit doesn’t just ask users to do tasks; they engineer FOMO. By publishing a public Leaderboard, users compete for higher rankings to split the USDT prize pool. The gap between ranks drives “task grinding,” and winners naturally “shill” their rankings on social media. This peer-to-peer competition is far more powerful than unilateral marketing.

Result: ProBit has built the most robust, scalable, and active community growth system, maintaining high retention rates.

4. BTCC: The Path of Compliance

As a veteran exchange, BTCC prioritizes risk control and steady development in a fractured global regulatory environment.

- Compliance > Max Traffic:Facing different licensing regimes, BTCC chooses precision over blind expansion.

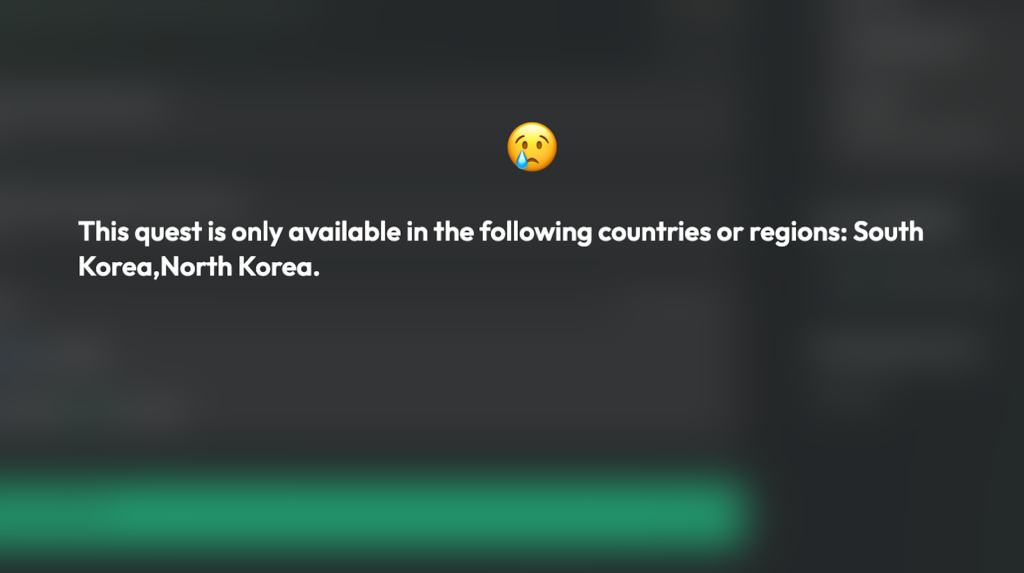

- TaskOn’s Secret Weapon: Regional Eligibility:BTCC heavily utilizes TaskOn’s Regional Eligibility feature. They can set specific Quests for users in Korea, Japan, or Taiwan. Users outside these regions simply cannot access the campaign page. This “Geofencing” precisely excludes users from sensitive jurisdictions, avoiding regulatory red lines.

- Localized Strategy:This allows for differentiated marketing based on local culture and regulations. While raw numbers might drop compared to a global open model, the quality skyrockets. It builds a safe, compliant, and deeply penetrated growth model.

Result: BTCC uses TaskOn not just for growth, but as vital infrastructure for Global Compliance.

VI. Metrics Comparison for Project Teams

| Dimension | Transaction Mining Model | TaskOn “Quest-to-Growth” Model |

| Structure | Single Metric: Trading Volume | TaskChain: First Order / MM Sprint / Accumulation Threshold / Advanced Actions |

| Verification | Statistical settlement, hard to backtrack | API / Signature / Order ID auto-verification, auto-claim Milestones |

| Behavior Quality | Prone to Wash Trading & Farming | Min. Amount + Time Window + Valid Counterparty Risk Control |

| User Segmentation | Vague / Blurry | Level System with clear progression paths & rights |

| Incentive Display | Post-event report, Opaque | Benefits Shop: Visible, Redeemable, Countdown timers |

| Sustainability | Activity Ends → Volume Collapses | Permanent Quests + Streaks (DayChain) retain users |

VII. Conclusion

CEX trading incentives should no longer be a brute-force “hashrate war.”

By using TaskOn, exchanges can transform the trading process into something taskified, stratified, and verifiable. Rewards are no longer scattershot; they are bonded to growth, tiered rights, and genuine depth.

In this way, the fiscal pressure is no longer about “burning cash for fake volume,” but investing in a healthier user structure and a more sustainable trading ecosystem.