In the realm of Web3 marketing, promoting a DEX (Decentralized Exchange) is often touted as “Hell Mode.”

Unlike Centralized Exchanges (CEXs) where a simple email sign-up gets you in the door, DEXs require users to have a wallet, understand Gas fees, wrap their heads around slippage, and possess the will to put real skin in the game by Swapping. Consequently, the Customer Acquisition Cost (CAC) for a single effective DEX user often hits $10 or even $20.

However, FlowX Finance, a leading DEX in the Sui ecosystem, shattered this norm.

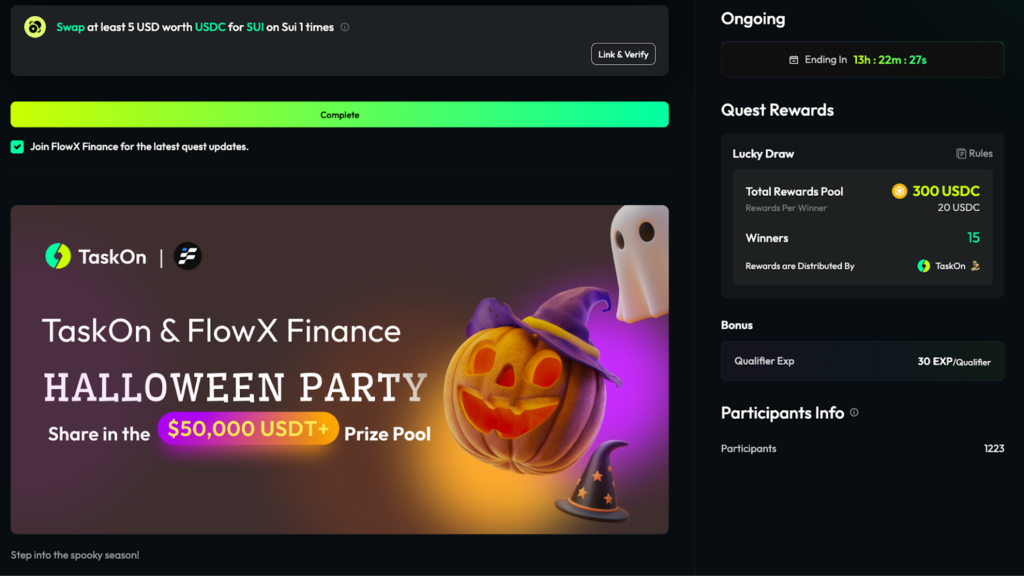

Through a TaskOn OnChain Quest, FlowX invested a mere $300 in prize money and successfully attracted 1,200+ real users to complete on-chain interactions. Crunching the numbers, that brings the CAC for a valid trading user down to an impressive $0.25.

How did they pull this off?

I. The Challenge: The DEX “Traffic Drought” and High Barriers

The hurdles FlowX faced are the same ones plaguing every DEX:

- User Inertia: Most users are only game for low-effort social tasks (like following a Twitter account) and hesitate to connect their wallets to trade unfamiliar tokens. The friction involved in jumping between platforms causes massive drop-offs.

- Budget Constraints: Not every project has the treasury of Uniswap. The dilemma is always: how do you maximize on-chain data with a tight budget?

- Data Validity: Many campaigns boast high participation numbers, but the actual On-Chain Data remains stagnant.

Traditional marketing campaigns suffer from a brutal conversion funnel:

User sees Quest -> Clicks link -> Connects Wallet -> Authorizes -> Trades -> Takes Screenshot -> Returns to Verify.

FlowX realized that to crush the CAC, they first had to kill the friction. They needed a mechanism that could guide users through an on-chain Swap firmly yet seamlessly.

II. The Solution: Precision Guidance via TaskOn OnChain Quest

Instead of the “spray and pray” approach, FlowX utilized TaskOn’s OnChain Quest module to execute a precision growth strategy.

1. Ultra-Low Barrier, Targeted Incentives

The campaign setup was straightforward: Users simply had to complete social media tasks and execute one Swap on the SUI network within the FlowX Quest to enter the lucky draw.

- Prize Pool: 300 USDT (20 USDT per winner).

- Mechanism: Complete the on-chain interaction, verify via TaskOn, and you’re in the draw.

2. Tech Stack: Router Integration for Verified Data

FlowX integrated its Router directly into TaskOn’s Aggregator. This was the game-changer:

- In-App Execution: Users didn’t need to leave the TaskOn interface to complete the FlowX trading task. By clicking “Swap” within TaskOn’s trading interface, the system directly called FlowX’s Router to execute the transaction.

- Closed-Loop Experience: Connect Wallet -> Select Token -> Trade Success -> Task turns green automatically. The entire process happened within a single UI—silky smooth.

- Zero-Friction Verification: Because the Router was called directly, the system captured the On-Chain Hash in real-time with 100% accuracy. This meant saying goodbye to manual screenshot reviews. Once the transaction hit the chain, the task status updated instantly.

3. Event Synergy: Riding the “EPIC” Wave

FlowX participated as part of TaskOn’s Halloween campaign. Empowered by the “EPIC” event series, a massive influx of users flooded the platform. By strategically positioning themselves within this high-traffic event, FlowX managed to funnel these users specifically into their OnChain Quest. During the EPIC cycle, choosing to embrace OnChain users rather than just OffChain volume proved to be the winning strategic play.

III. The Results: An On-Chain Explosion

The campaign results validated that the TaskOn community holds a deep reservoir of high-quality, active DeFi users—they just need the right trigger.

- Total Prize Pool: 300 USDT

- On-Chain Participants: 1,200+

- CAC: ~$0.25

- On-Chain Growth: 1,200+ verified transaction hashes on-chain.

To put this in perspective: with the same budget, traditional ad spend might have garnered 100 clicks. On TaskOn, FlowX acquired 1,200 actual traders.

IV. Conclusion: A Blueprint for Big Data on a Small Budget

The FlowX case study serves as a masterclass for all DEXs and DeFi protocols: Growth doesn’t necessarily require “burning cash.”

By leveraging TaskOn OnChain Quest, projects can ensure their budget is spent with surgical precision—where every penny of the prize pool corresponds to a genuine on-chain interaction.

For any DEX struggling with sluggish on-chain metrics and skyrocketing acquisition costs, FlowX has provided a replicable, standard answer.