How Trading Competitions Identify Real Users and Boost On-Chain Activity

01|Why Trading Races Matter

In a decentralized environment, volume alone is not growth — genuine activity is.

Trading Races are designed to separate real traders from fake volume, transforming raw transaction data into verifiable engagement.

By setting up clear competition rules, net-volume algorithms, and season-based settlements, projects can:

- Identify authentic trading users.

- Increase sustainable trading volume.

- Discourage wash-trading behaviors.

- Motivate long-term engagement through tiered leaderboards.

Trading Races are now a core growth tool for DEXs, lending platforms, and perpetual trading projects seeking healthy on-chain metrics.

03|Understanding Trading Races on TaskOn

TaskOn has launched a new Trading Competition Module, now accessible in the announcement section. This powerful feature allows projects to create and manage their own trading contests by defining key parameters such as the total prize pool, swap targets, and specific eligibility criteria. The module supports setting up multiple prize pools within a single competition, each configurable with its own unique ranking rules.

The competition page offers full customization to match your project’s brand, allowing you to edit the competition name, set start and end times, and control the banner and dynamic visual effects. Crucially, you can define rankings based on trading volume, with automated prize distribution tied directly to the final leaderboard. This setup effectively incentivizes users to participate and trade more.

02|From Design to Launch — Core Framework

| Phase | Key Focus | Description |

| Setup | Competition Type | Individual |

| Metrics | Trading Volume | |

| Settlement | Real-time leaderboard + season rewards | |

| Reward Logic | Top ranks + random draws + milestone badges |

This structure ensures that every transaction contributes to verifiable, meaningful growth.

03|Net Volume: Defining the “Clean Metric”

Raw trading volume can be easily inflated.

The Net Volume formula filters out circular or self-matched trades to reflect real market activity.

Basic formula:

Net Volume = (Buy Volume + Sell Volume) − (Matched Volume between the same wallet pair)

Core principles:

- Wallet-pair exclusion: Detect reciprocal buys/sells between identical or correlated addresses.

- Direction filtering: Only count net positive exposure, not round-trip loops.

- Holding validation: Confirm a minimum holding period after trade (e.g., 1 minute) before counting.

- Volume cap per interval: Prevent algorithmic micro-trades from dominating rankings.

Result: a leaderboard that reflects real traders, not bot patterns.

04|Anti-Wash Trading Detection

Wash-trading distorts metrics and rewards.

TaskOn’s Trading Race model integrates multi-layer detection to preserve fairness:

- Address correlation analysis: Track repeated counter-orders between wallets sharing gas history, device fingerprints, or funding sources.

- Directional flow mapping: Spot mirrored buy/sell cycles with minimal time gaps.

- Net exposure checks: Flag accounts with near-zero position change despite high volume.

- Behaviour clustering: Machine-learned clusters of “bot-like” frequency or identical order intervals.

Suspicious trades are either excluded from scoring or automatically downgraded through a weighted penalty model.

05|Competition Modes and Scenarios

Each format can be customized through TaskOn’s Quest Engine, linking participation with on-chain proof and referral growth.

06|Data Tracking & On-Chain Growth Metrics

Beyond volume, trading competitions drive multiple on-chain growth indicators when properly structured:

| Metric | How It’s Measured | Growth Impact |

| Active Addresses | Unique wallets completing verified trades | Measures reach & DAU |

| Net Transactions | Clean trade count after filtering | Shows genuine market depth |

| TVL Growth | Staked or locked assets from race participation | Reflects liquidity expansion |

| User Retention | Repeat participation across races | Indicates long-term adoption |

To make this measurable, every action is taskified — “Deposit → Trade → Hold → Share.”

Each task feeds into the competition index table, which maps wallet activity to user scoring.

07|Output: Trading Race Metric Table

| Category | Indicator | Definition | Validation Source |

| Volume Metrics | Net Trading Volume | Sum of valid trades per user | On-chain TX logs |

| Counter-Trade Ratio | % of self-matched transactions | Cross-wallet mapping | |

| Engagement Metrics | Active Trading Days | Number of distinct days traded | Activity logs |

| Referral Conversions | New users from invites | Referral tracking | |

| Performance Metrics | PnL Accuracy | Profit vs exposure ratio | DEX analytics |

| Season Points | Aggregated weighted score | Leaderboard index | |

| Quality Metrics | Wash-Trade Penalty Index | Weighted penalty for abuse | Anti-bot engine |

| Net Volume Accuracy | Clean / Total Volume ratio | Validation system |

This table becomes the foundation for settlement and transparency reports — essential for fairness and credibility.

09|Integration with DeFi Scenarios

Trading Races can be adapted beyond DEXs:

- Lending Protocols: reward users for borrowing, repaying, or maintaining healthy collateral ratios.

- Yield Aggregators: gamify portfolio rebalances as “strategy races.”

- Cross-Chain Bridges: reward highest valid transfer volumes within timeframe.

In every case, the principle remains the same — reward verified, net-positive actions that improve protocol metrics.

10|Who Should Use This Model

✅ Centralized Exchanges: to energize trading communities with anti-wash safeguards.

✅ Decentralized Exchanges: to grow real liquidity and on-chain engagement.

✅ Lending / Perpetual Platforms: to convert volume spikes into sticky user retention.

Trading Races are not just marketing events — they are data engines for identifying real users.

How QLS used Trading Race to increase Onchain Activity

This campaign was designed to incentivize on-platform activity by creating a competitive environment centered around a key metric: Trading Volume. QLS defined the Basic Pool rules clearly, stating that users on the leaderboard with a trading volume of ≥$100 would share the total prize pool of $1155.

The visual element of the leaderboard, showing user rankings, estimated rewards, and individual trading volumes, created transparency and a strong element of competition. This feature is effective because it directly links a specific, desired on-chain action (trading/liquidity provision) to a quantifiable reward, driving over 392 total transactions and achieving a high Trading Volume ($316K+) from the participants, thereby boosting the platform’s utility and Total Value Locked (TVL).

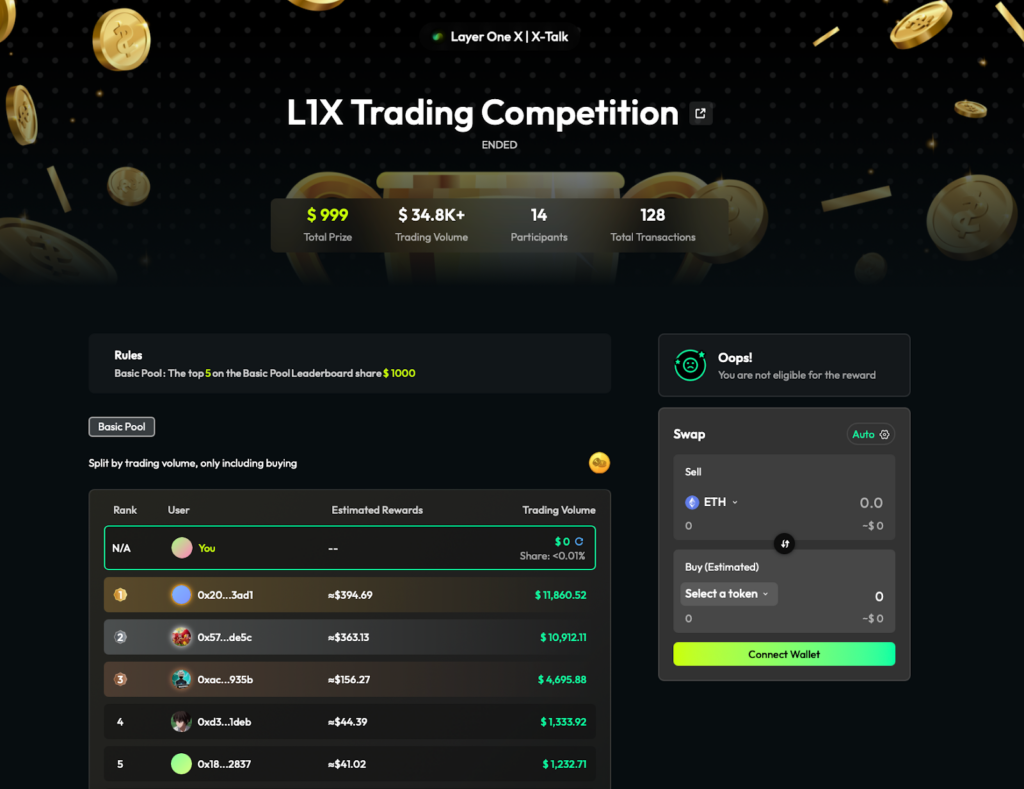

Analysing the L1X Trading Competition (Limited Rewards)

The project’s strategy was to foster intense competition and drive significant trading activity by offering a substantial Total Prize of $999 to a select group of high performers. The rules for the Basic Pool explicitly stated that only the top 5 on the Basic Pool Leaderboard would share the $1000 prize. This “winner-take-all” or “top-tier” reward structure, combined with the real-time leaderboard displaying estimated rewards and individual trading volumes, created a strong incentive for the 14 participants to engage in 128 total transactions, generating a notable $34.8K+ in Trading Volume.

By limiting the reward pool to the top contributors, the project effectively maximized competitive drive, encouraging participants to strive for higher trading volumes to secure a place on the leaderboard and claim a share of the enticing prize.

11|Conclusion

A well-built Trading Race transforms “volume chasing” into evidence-based growth.

By focusing on net volume, anti-wash detection, and season settlements, DEXs and exchanges can:

- Reward real users, not bots.

- Boost clean liquidity.

- Track on-chain activity that truly reflects product adoption.

With TaskOn’s built-in data tracking, leaderboard systems, and customizable metrics table, every project can now turn trading into a transparent growth engine — measurable, fair, and viral.